Supporting Growth In Montgomery County

Montgomery County, Maryland, has experienced a huge jump in Venture Capital investment — more than half a billion dollars in the first half of 2018 alone. Investment is growing to support our innovative thinkers to start and expand in the County.

VC INVESTMENT IN 2021

LIFE SCIENCE VC INVESTMENT IN 2021

LIFE SCIENCE DEALS FROM 2015-2020

DEALS FROM 2015-2020

TEDCO’s Seed Investments exist to support Maryland companies in their effort to develop and commercialize new technology-based products. TEDCO’s investment truly makes a difference in helping them advance their technologies further along the commercialization pathway, which can increase the company’s valuation and lead to follow-on investment, sustainability, and job creation.

on the Rise—Investment update for October 2019

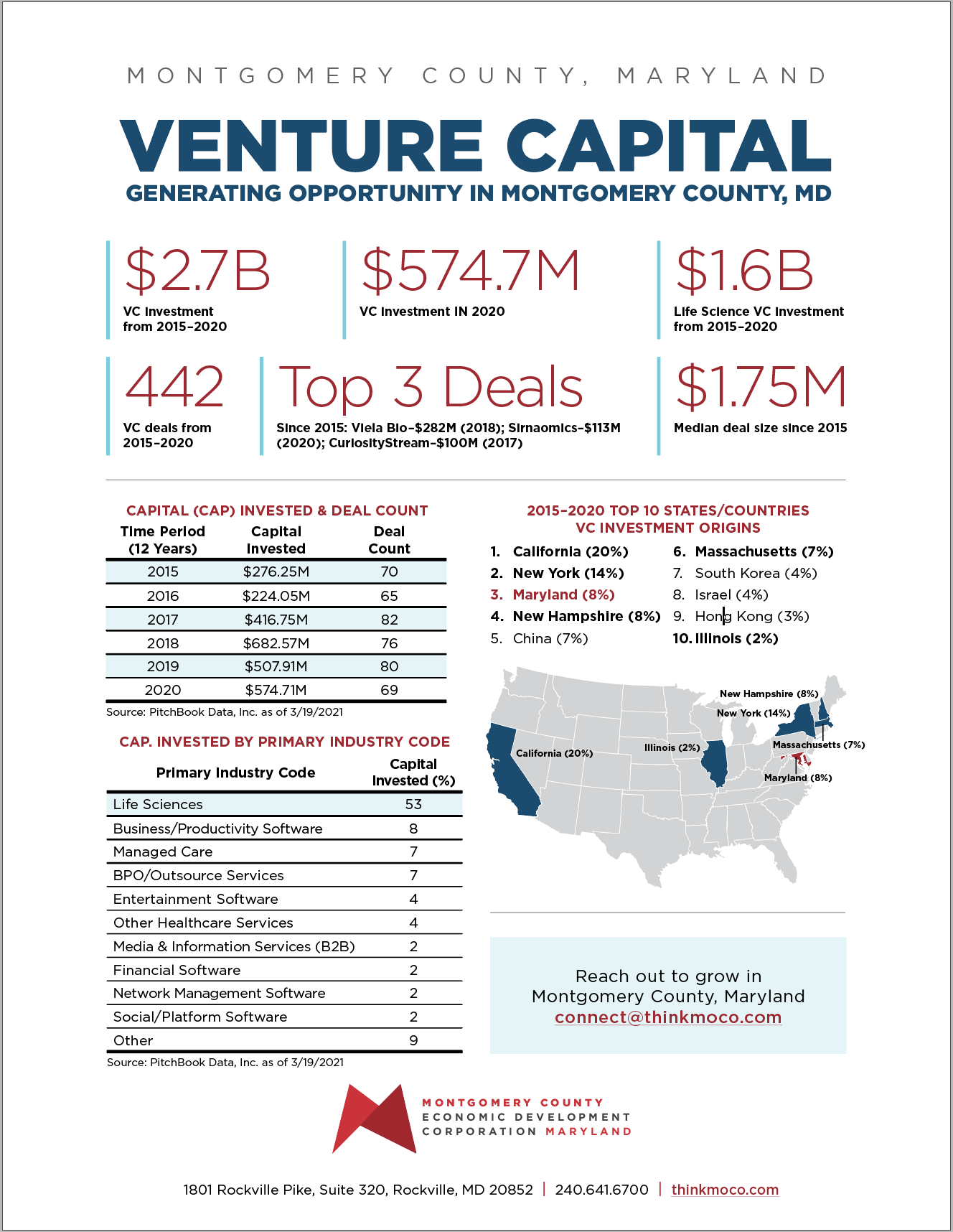

Venture Capital investment in Montgomery County companies continues to be strong and diverse. Montgomery County companies raised $2.7 billion in venture capital from 2015–2020.

LARGEST VC DEALS FROM 2015–2020 +

LIFE SCIENCES

Sirnaomics, Gaithersburg, $173M in January 2019-December 2020

Arcellx, Gaithersburg, Life Sciences, $85M in October 2019

Viela Bio, Gaithersburg, Life Sciences, $387M in March 2018-June 2019

Regenxbio, Rockville, $70M in May 2015

CHẾ TẠO TIÊN TIẾN

Xometry, Gaithersburg, $75M in September 2020

HEALTH MANAGEMENT

Aledade, Bethesda, $120M in January 2019-2020

ENTERTAINMENT

Curiosity Stream, Silver Spring, $100M in December 2017

Funding success

Venture capital investors can provide:

Seed funding to help new companies get off the ground

Assist established companies looking to grow

Help a company commercialize a product or idea

Some VC firms specialize in healthcare, biotech, IT or cybersecurity, while others look for a ‘disruptor’ in a category. The County is fortunate to have companies supporting funding and innovation.

Public Funding Resources

TEDCO provides knowledge, funding and networking to support innovators, researchers, entrepreneurs, start ups and early stage companies. Its mission is to bring innovative ideas to market. TEDCO also makes available Network Advisors to help meet the unique needs of Maryland start-up companies.

ĐỌC THÊM +

TEDCO helps by advancing ideas from research labs to commercialization; assisting start-ups with knowledge and resources to launch; and helping established companies expand to the next phase of commercial success.

Created by the Maryland State Legislature, TEDCO has made available $1 million in new economic development funds that will provide startup technology companies with investment capital to help cover the gap between seed funding and venture capital investments.

Maryland Venture Fund is an early-stage venture capital fund specifically dedicated to growing the next generation of innovative businesses in Maryland. In addition to funding, they lend their considerable expertise to companies to help make the business successful. Maryland Venture Fund has more than $100M in assets, giving them the scope to partner with exceptional entrepreneurs to build great companies with a bright future. The website features a Send us your Pitch Deck link to help move forward early-stage businesses.

The Dingman Center Angels connects regional start-up companies seeking seed and early-stage funding with investors.

MSBDFA Equity Participation Investment Program (EPIP) provides equity investment in socially or economically disadvantaged businesses.

Maryland Momentum Fund at The University System of Maryland (USM) has launched an early-stage investment fund to increase new company creation and commercialization of its leading-edge research. Participants must be a Maryland-based company and other eligibility requirements apply.

The State of Maryland Business Assistance Program is a searchable database including loans, grants and venture capital.

top public investors from 2015 to 2020

Maryland Venture Fund: 11 deals

TEDCO: 27 deals

Blu Venture: 10 deals

ImpactAssets: 9 deals

Keiretsu Forum: 8 deals

Plug and Play Tech Center: 8 deals

Local Investment Firms Fuel Growth

Many VC firms locally and from around the country recognize the benefits of investment in Montgomery County. The following two Venture Capitalists, Keiretsu Forum and Revolution have funded multiple deals in Montgomery County.

READ MORE ABOUT LOCAL VC FIRMS +

Keiretsu Forum is a private equity angel investment organization serving the region, and has an office in Bethesda. It is part of a global investment community of accredited private equity angel investors, venture capitalists and corporate/institutional investors. Keiretsu Forum is a worldwide network of capital, resources and deal flow with 52 chapters on 3 continents.

Promaxo, Rockville, MD. A biohealth company with a focus on prostate cancer screening, biopsky and treatment.

Otomagnetics, Rockville, MD. A woman-owned, minority owned company that is a University of Maryland College Park spin out. The growing company’s innovative approach is in developing non-invasive ways to deliver drugs and other therapies to inner and middle ear, the eye and the skin.

Revolution focuses on investing in people and ideas that can change the world, and that fits in perfectly with Montgomery County businesses. They look for ‘disruptors’ that think out of the box, focusing on industries on the verge of change.

Homesnap provides real-time MLS data to make home searching easier; funding is for the a Business to Consumer app. Based in Bethesda.

Insightin Health helps companies personalize communication, improve CRM and connect big data to people, from its Gaithersburg location.